Retirement. It’s something you’ve thought about for years but kept saying you will deal with it nearer the time. But how do you make sure you’re ready to deal with change when you do come to retire?

So this blog is not about money, it’s about managing change, anxiety and relationships during one of the biggest changes in your life. It has been adapted from an US article.

Retirement might be your time to do your own thing, to travel overseas, go bush in the outback, spend quality time with your loved ones, to return to education, start a different career, take up a volunteer activity, begin an exercise program, or pursue a hobby. There are so many things you could be doing with your newfound time. It seems as though the possibilities for life changes in retirement are endless. But many struggle in that initial period.

Even though you are excited to enter this new stage of life, the amount of change can feel overwhelming and it can intimidating to handle change in retirement. If a lifetime of work demanded much of your time and attention, you may not have had the opportunity to develop many leisure time interests. You may find yourself looking for new things to do and get involved with.

If many of your social activities have involved people from work, you may want and need to develop friendships that are based on your new interests (think about Rotary, Probus, Men’s Shed, Book Club, Classic Car Group, Yoga, Red Hat Society, Bush Walking Club etc.). If you are retiring and adjusting to an empty nest at the same time, you may feel especially challenged handling all of this change associated with retirement. Despite wanting to retire, adapting to so many changes in your life can be difficult.

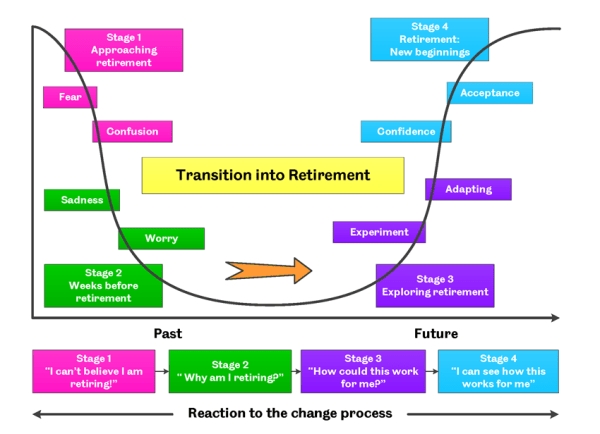

How you’ve handled change during your lifetime can offer insight into how well you’ll adapt to change in retirement. Having an awareness of how to better manage change can improve your adjustment to retirement.

Here are ten questions to ask yourself about handling life changes in retirement:

1. What changes do you want to make in your life? This is a big question but you probably have some ideas of things you’d like to start doing or do more of. Exercise, travel, family time and household projects are all common starting points. Make a list and begin to identify all the ways you want to change your life in retirement. Tip for Ladies: Is your husband struggling for ideas? Try “101 Things to Do With A Retired Man: … to Get Him Out From Under Your Feet!”

2. Why do you want to make these changes? It’s not enough to say you want to improve your diet or read more books. It’s time to figure out the benefits of making these changes. What will you gain by eating differently or reading more? Recognise why you want to make the change so that you’ll be encouraged to follow through with it.

3. What change do you want to make first? If you’ve been thinking about all you could do in retirement, you may discover that it’s hard to figure out where to begin. Feeling overwhelmed by the choices may mean that you don’t select anything. Keep it simple. If you could change just one thing, what would it be?

4. What impact will your changes have on others? Often if we change something in our life, it has a domino effect. If you go back to school, you may need to use weekend time for studying. If your volunteer project involves evenings, you may need to give up some family time. Recognise that others in your life may question the changes that involve them. Talk about the upcoming changes with significant others and gain their support.

5. Are you willing to change? Are you going to be frustrated making a change in your life when it isn’t something you truly want to do? If you’re a stay-at-home person, don’t kid yourself and try to adopt a freewheeling, caravanning lifestyle just because others say you’ll love it. This is could be a change that you won’t really be willing to make long-term.

6. Are you ready to change? It’s one thing to say you want to start exercising, volunteering or start learning a language. Doing it may be harder than you think. You may be someone who finds change is really difficult. If that’s you, prepare yourself mentally for more challenges right at the start.

7. Are you prepared to make the effort? Making changes in your life requires an effort. Be ready for a learning curve and some inherent frustrations. As adults, we get comfortable in our habits and routines. If you really want to begin an exercise program, you may need a significant amount of willpower to get yourself started.

8. Who can help you change? When you’re learning something new, ask for help. Join a group, connect online or ask others in your network for advice. You may have spent your whole life wanting to figure things out for yourself. Recognise that your time now is a valuable resource. Don’t waste it. Ask for help.

9. Can you check your ego at the door? The first time you try doing something new, it’s likely you won’t be great at it. New things take practice. Don’t let your fear of failure or ego get in the way of learning something new. Look at it this way—you made it this far in life, you are certainly capable of learning a yoga pose or to put up shelves.

10. Are you seeing the results you expected? Make your changes and give yourself a reasonable amount of time to get used to them. Are you seeing the benefits you expected? If not, chalk it up to good experience and move on.

Accept that retirement will bring many changes in your life. Increasing your awareness about how you adapt to change will contribute to your overall retirement happiness.

Looking for an adviser that will keep you up to date and provide guidance and tips like in this blog? Then why not contact me at our Castle Hill or Windsor office in Northwest Sydney to arrange a one on one consultation. Just click the Schedule Now button up on the left to find the appointment options. Do it! make 2018 the year to get organised or it will be 2028 before you know it.

Please consider passing on this article to family or friends. Pay it forward!

Liam Shorte B.Bus SSA™ AFP

Financial Planner & SMSF Specialist Advisor™

Tel: 02 98941844, Mobile: 0413 936 299

PO Box 6002 BHBC, Baulkham Hills NSW 2153

5/15 Terminus St. Castle Hill NSW 2154

Corporate Authorised Representative of Viridian Select Pty Ltd ABN 41 621 447 345, AFSL 51572

This information has been prepared without taking account of your objectives, financial situation or needs. Because of this you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation and needs. This website provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such.

I have adapted this content to Australian circumstances from an original American article on retirementstyle.com By Deborah Williams