Sigh of relief!

Thankfully after the reams of changes to superannuation in last years budget that we are still trying to negotiate the through the implementation minefield, the government have left SMSFs and Superannuation largely untouched this year. As the SMSF Association have said “Stability and confidence for superannuation is the good news coming out of the 2017-18 Federal Budget.” However there are a few issues and gladly opportunities you need to be aware of.

Contributing the proceeds of downsizing your home to superannuation (or just taking advantage of strategy if moving house)

Tip: If you’re over 65 self funded retiree and your marginal tax rate is more than 15% then strategy may be useful. May also help avoid the Medicare levy increase in 2 years time.

It is proposed that from 1 July 2018, people aged 65 and over will be able to make a non-concessional contribution of up to $300,000 from the proceeds of selling their home. These contributions will be in addition to the existing contribution caps.

Features associated with this measure include:

- The property must have been the principal place of residence for a minimum of 10 years

- Both members of a couple will be able to take advantage of this measure for the same home, meaning $600,000 per couple can be contributed to superannuation through the downsizing cap

- Amounts will count towards the transfer balance cap when used to commence an income stream

- Contributions will be subject to social security means testing when added to a superannuation account

Contribution eligibility requirements, such as the work test and restrictions on contributions from age 75 will not apply to these contributions. The requirement to have a total superannuation balance of less than $1.6 million to be eligible to contribute will also not apply.

Social security changes

Pensioners who lost their Pensioner Concession Card entitlement due to the assets test changes on 1 January 2017 will have their card reinstated. This card provides access to a wider range of concessions than those available with the Health Care Card, such as subsidised hearing services. Pensioner Concession Cards will be automatically reissued over time with an ongoing income and assets test exemption.

As of 1 July 2018, there will be stricter residence requirements for the age pension and disability support pension. From that date, pension recipients will need to have at least 15 years’ residence in Australia or 10 years’ continuous residence with certain restrictions.

First home super saver scheme – talk to us about how you can use this to help your children or grandchildren

From 1 July 2017 individuals will be able to make voluntary contributions to superannuation of up to $15,000 per year and $30,000 in total, to be withdrawn for the purpose of purchasing a first home. Both voluntary concessional and non-concessional contributions will qualify.

These contributions (less tax on concessional contributions) along with deemed earnings can be withdrawn for a deposit from 1 July 2018. When withdrawn, the taxable portion will be included in assessable income and will receive a 30 per cent offset.

Features associated with this measure include:

- Contributions will count towards existing concessional and non-concessional contribution caps

- Earnings will be calculated based on the 90 day Bank Bill rate plus three percentage points.

- The ATO will administer this scheme, calculate the amount that can be released and provide release instructions to superannuation funds.

- The amount withdrawn (including the taxable component) will not flow through to income tests used for tax and social security purposes, such as for the calculation of HECS/HELP repayments, family tax benefit or child care benefit.

Example of how to use this strategy: Get your child or grandchild to salary sacrifice up to $15,000 each year until they max out the $30,00 limit and let them live at home or support their living costs to ensure they can still make ends meet. This way you promote a savings culture and they get a tax incentive at the same time. Boost the savings by matching what they put in to the super account dollar for dollar in to an High Interest Savings account.

If you are giving money to children then teach them a valuable life lesson on regular saving at the same time…best gift you can give to them.

Bank levy may hit dividends or term deposit rates

The Government will introduce a major bank levy which will raise $6.2 billion in the next four years. This will either be passed on to customers with lower rates on deposits or higher mortgage rates or to shareholders in the form of lower dividends. Another good reason to review your exposure to the large banks as the market cycle changes.

PROPERTY INVESTORS

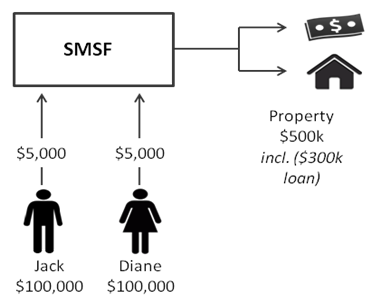

Integrity of limited recourse borrowing arrangements

The Government is proceeding with amendments to the transfer balance cap and total superannuation balance rules for limited recourse borrowing arrangements (LRBAs). The outstanding balance of an LRBA will now be included in a member’s annual total superannuation balance for all new LRBAs once this legislation is passed.

Integrity of non-arm’s length arrangements

The Government will amend the non-arm’s length income rules to prevent member’s using related party transactions on non-commercial terms to increase superannuation savings by including expenses that would normally apply in a commercial transaction.

Disallow certain deductions for residential rental property

From 1 July 2017, deductions for travel expenses related to inspecting, maintaining or collecting rent for a residential rental property will be disallowed.

Investors will not be prevented from engaging third parties such as real estate agents for property management services. These expenses will remain deductible.

Also from 1 July 2017, plant and equipment depreciation deductions will be limited to outlays actually incurred by the SMSF in residential real estate properties. Plant and equipment items are usually mechanical fixtures or those which can be ‘easily’ removed from a property such as dishwashers and ceiling fans. Here’s the list of residential #property plant and equipment items that will go in crack down on negative gearing deductions. Here’s the list of residential property plant and equipment items that will go in crack down on negative gearing deductions.

This measure addresses concerns that some plant and equipment items are being depreciated by successive investors in excess of their actual value. Acquisitions of existing plant and equipment items will be reflected in the cost base for capital gains tax purposes for subsequent investors.

Other matters: Energy Assistance Payment

A one-off Energy Assistance Payment will be made in 2016-17 of $75 for single recipients and $125 per couple for those eligible for qualifying payments on 20 June 2017 and who are a resident in Australia.

Qualifying payments include the Age Pension, Disability Support Pension, Parenting Payment Single, the Veterans’ Service Pension and the Veterans’ Income Support Supplement, Veterans’ disability payments, War Widow(er)s Pension, and permanent impairment payments under the Military Rehabilitation and Compensation Act 2004 (including dependent partners) and the Safety, Rehabilitation and Compensation Act 1988.

I hope this guidance has been helpful and please take the time to comment. Feedback always appreciated. Please reblog, retweet, like on Facebook etc to make sure we get the news out there. As always please contact me if you want to look at your own options. We have offices in Castle Hill and Windsor but can meet clients anywhere in Sydney or via Skype. Just click the Schedule Now button up on the left to find the appointment options.

Liam Shorte B.Bus SSA™ AFP

Financial Planner & SMSF Specialist Advisor™

Tel: 02 98941844, Mobile: 0413 936 299

PO Box 6002 BHBC, Baulkham Hills NSW 2153

5/15 Terminus St. Castle Hill NSW 2154

Corporate Authorised Representative of Viridian Select Pty Ltd ABN 41 621 447 345, AFSL 51572

This information has been prepared without taking account of your objectives, financial situation or needs. Because of this you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation and needs. This website provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such.