Even the most seasoned SMSF Trustees and members realise that they need to be on top of their game over the coming 12 months. If you are running your own SMSF or your better half is doing so, then drag yourself and them along to the SMSF Association’s SMSF & Investor Event. Let the experts guide you.

Full disclosure, I am a board member of the SMSF Association and I do want as many people as possible to come along and boost their knowledge and be prepared for what the budget and possible new future government will throw at us. I have also bargained for a deal for you and if you use the coupon code “SMSFCoach” when registering you will be able to attend for FREE

So what is on the agenda:

Following the Federal Budget and leading up to the end of the financial year, hear from key SMSF and investment experts on crucial factors you as a trustee or your clients if you’re a n SMSF professional,, should be thinking about in regards to your fund/your clients’ funds. The program will feature:

- A Special Address on the impact of the removal of franking credit refunds on SMSFs

- Your SMSF Update – what’s new in self managed super

- End of Financial Year – review your investment portfolio in light of political and investment markets

- Peter Hogan our SMSF Education expert will discuss Everything you need to know about starting and receiving pensions – whether you are starting to think about moving into retirement or already earning a pension this session will cover everything you need to know especially as it relates to the Transfer Balance Cap.

- And more to be announced soon…

WHERE & WHEN

Date: Tuesday 9 April 2019

Time: 8:15am – 3:30pm (including lunch and morning tea)

Venue: Aerial UTS Function Centre, Building 10, Level 7/235 Jones St, Ultimo, Sydney

Register here using the coupon code ‘SMSFCoach’ for Free

(I confirm that I receive no commissions, fees or incentives for promoting this event and will not receive any of your private information)

SHOUT OUT TO SMSF PROFESSIONALS

If you are a SMSF Accountant, Auditor or Financial Planner then please pass on this opportunity to your clients as we need SMSF Trustees to be more knowledgeable than ever. Understand that ASIC now expects you to be providing education to your clients and you must find cost effective ways of doing this. Why not leverage of your association membership and provide your clients with access to this event or maybe even come along with a group of them.

If you are in Victoria don’t feel left out we will be coming to Melbourne too in June!

Liam Shorte B.Bus SSA™ AFP

Financial Planner & SMSF Specialist Advisor™

Tel: 02 98941844, Mobile: 0413 936 299

PO Box 6002 BHBC, Baulkham Hills NSW 2153

5/15 Terminus St. Castle Hill NSW 2154

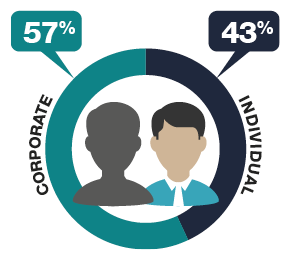

Corporate Authorised Representative of Viridian Select Pty Ltd ABN 41 621 447 345, AFSL 51572

This information has been prepared without taking account of your objectives, financial situation or needs. Because of this you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation and needs. This website provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such.