OK, It has happened. I always worried that British pride and fear of immigration would lead to this outcome. So where to from here? What does it mean for SMSF Investors?

The situation is unprecedented and there is no verified or tested procedure for EU exit. This means there is uncertainty as to what happens next. You can expect that:

- Article 50 of the EU constitution – the law governing the process of the UK’s divorce from the EU – will be triggered

- This will kick-start the formal two-year process determining the terms of the UK’s EU exit, including the shape of its future access to the EU Single Market

- There will be significant pressure on Prime Minister David Cameron to resign (Update: that has happened) and for Scotland to review its position within the UK

In the short run, Self Managed Superannuation Fund investors can expect:

- Shock to investor confidence and increased asset price volatility primarily in the EU but also with Aussie companies who have exposure to that region especially the UK (BTT, CYBG, Henderson, HVN, IRESS)

- This vote combined with global economic conditions, high asset valuations, our election next month and the progress towards the U.S. election in November will all likely contribute to volatility through the second half of the year.

- Further strength in the Aussie Dollar short-term and declines in the pound (time to pay in advance for the UK trip of a lifetime!)

- Downward pressure on equities, especially financial sector stocks and companies with overseas earnings. Time to buy the world at a discount. If not confident then look to great proven managers like Magellan and Platinum to pick the opportunities and ETFs from Vanguard, Ishares, State Street and Betashares for core or sector specific exposure.

- Flight to safety will see USD and GOLD seen as safe havens. We can point you to the right people if interested in Bullion

- Upward pressure on corporate bond yields owing to increased uncertainty and the worsening short term growth outlook – as with equities, the financial sector is most

exposed. Look to proven managers in this fixed interest and credit space like Vimal Gor at BT Investment Management to guide you. - Modest declines in-house prices are possible, as our banks may find it harder to raise overseas debt and therefore pass on increased costs to borrowers and hence curtail new purchases.

The leave vote will create short-term volatility and hurt growth prospects as markets deal with increased uncertainty. Inevitably however, the increased volatility should open up potential opportunities to benefit tactically through buying of those companies and assets that show solid traits of being well capitalised and with good management that should be able to best withstand the uncertainty. In a nutshell you will get a one-off opportunity to buy quality assets as a discount but you must search for quality among the chaff.

From time to time, as with the Greek debt Crisis, equity markets experience heightened, event-related volatility. A good adviser will ensure that you focus on your long-term goals and understand:

- Volatility is a normal part of long-term investing and equity returns premium revolve around getting higher than cash returns for accepting that volatility.

- Avoid being swayed by media hype and overly negative sentiment.

- SMSF trustees and other long-term investors are usually rewarded for taking additional equity risk when there is “blood on the streets”

- Market corrections can create attractive opportunities to buy quality assets at a discount. Afraid to pick sectors then use a multi-manager like Russell Investments to spread the risk

- Some active investment can help navigation in periods of increased volatility. That is why we at Verante believe in passive/active blended portfolio design

So what to do?

- Make sure you have some cash ready for purchases

- Review your portfolio for any stocks or assets over exposed to Europe and seek research or comment on them

- Wait for some sign of the market bottoming and take small and targeted purchases in discounted sectors without getting carried away.

- Research , research and more research or outsource / work with SMSF specialist advisors like us who have made the contacts and done the leg work in portfolio design.

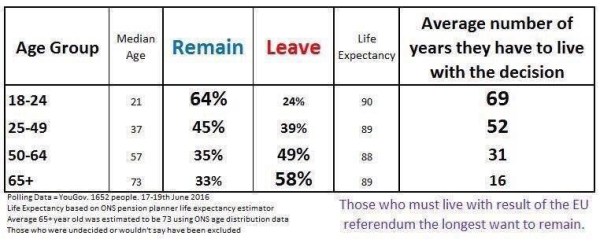

Finally a table that sums up the fact that those who have to live with this decision were against it.

I hope this guidance has been helpful and please take the time to comment. Feedback always appreciated. Please reblog, retweet, like on Facebook etc to make sure we get the news out there. As always please contact me if you want to look at your own options. We have offices in Castle Hill and Windsor but can meet clients anywhere in Sydney or via Skype. Just click the Schedule Now button up on the left to find the appointment options.

Liam Shorte B.Bus SSA™ AFP

Financial Planner & SMSF Specialist Advisor™

Tel: 02 98941844, Mobile: 0413 936 299

PO Box 6002 BHBC, Baulkham Hills NSW 2153

5/15 Terminus St. Castle Hill NSW 2154

Corporate Authorised Representative of Viridian Select Pty Ltd ABN 41 621 447 345, AFSL 51572

This information has been prepared without taking account of your objectives, financial situation or needs. Because of this you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation and needs. This website provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such.