From the media hype you should already know that self-managed superannuation funds (SMSFs) can borrow funds to purchase assets, provided the borrowing satisfies certain requirements outlined in the Superannuation Industry (Supervision) Act 1993. This can be a very attractive option for SMSF trustees for a number of reasons.

From the media hype you should already know that self-managed superannuation funds (SMSFs) can borrow funds to purchase assets, provided the borrowing satisfies certain requirements outlined in the Superannuation Industry (Supervision) Act 1993. This can be a very attractive option for SMSF trustees for a number of reasons.

This is Part 1 of a 3 part series. In this first article, we will look at the background to the limited recourse borrowing arrangements that can be used by SMSFs to invest in an asset, specifically a residential or commercial property.

Limited recourse borrowing arrangements

While the Superannuation Industry (Supervision) Act contains a general prohibition against borrowing, SMSF trustees have been able to borrow to acquire assets since September 2007. The Act was further amended in July 2010 with the introduction of new legislation that clarified the intended operation of the borrowing exemption. The rules around the use of borrowed funds for repair and improvement and what is an acquirable asset were further clarified in 2012.

SMSFs may borrow funds to acquire an asset provided the following conditions are satisfied:

1) Single acquirable asset: The borrowed funds must be used to acquire a single asset or a collection of identical assets that have the same market value (which are together treated as a single asset), which the fund would otherwise be permitted to acquire. A single asset could be a parcel of, for example, 1000 ANZ Bank shares, but a parcel of 500 ANZ Bank shares and 500 Woolworth’s shares would not meet the definition of a single asset.

2) Restriction on improvements: The borrowed funds are not to be used to improve the acquirable asset. The ATO recently confirmed its position in relation to repairs vs. improvements of an asset acquired through a limited recourse borrowing arrangement in Self Managed Superannuation Funds Ruling SMSFR 2012/1. For example, if a fire damages part of a kitchen (e.g. the cooktop, benches, walls and the ceiling), the SMSF trustee could use the borrowed funds to restore or replace the damaged part of the kitchen with modern equivalent materials or appliances, but it could not use the borrowed funds to extend the size of the kitchen (as this would be considered an improvement).

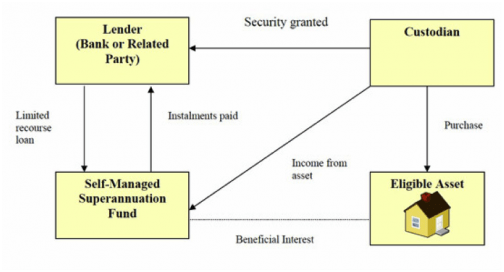

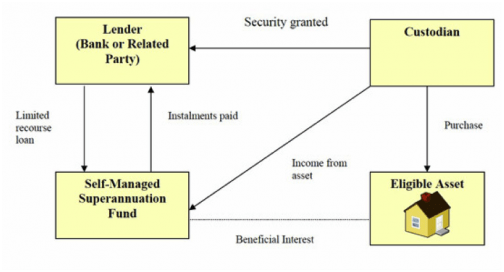

3) Beneficial ownership: The acquired asset must be held on a trust where the super fund holds the beneficial interest in the acquired asset. This requires what is known commonly as a ‘bare trust’ or a ‘custodian trust’ to be registered as on the title as the legal owner. This is one of the reasons why the process can get complicated and is the main mistake made in implementing this strategy without doing the groundwork first.

4) Legal ownership: the documentation makes it very clear that the actual beneficial owner is the trustee of the self-managed super fund. After acquiring this beneficial interest, the SMSF has the right to acquire the legal ownership of the asset once it has repaid in full the lending for the property purchase.

5) Limited recourse rights of lender on default: If the fund defaults on the borrowing, the rights of the lender under the arrangement are limited to rights relating to the acquired asset. In other words, the lender’s rights are limited to repossessing and disposing of the asset to recover funds. The lender cannot recover funds from the superannuation fund’s other assets or undertakings. However it can become common practice for the lenders to seek personal guarantees from the trustees in their private capacity to add a layer of protection for the lender

6) Restriction on replacement assets: The acquired asset can be replaced by another acquirable asset (but only in very limited circumstances). For example, the proceeds of a claim after a fire destroys a four-bedroom home could be used to rebuild a four-bedroom home in a newer style but you could not build three town-houses on the same site using the funds.

Types of property that can be acquired

An SMSF can only borrow money to acquire an asset if it would not be prohibited from investing in that asset directly under the Act. This includes residential units, houses, commercial property like office units, industrial warehouses and a current flavour of the day: 7/11 stores! A SMSF is prohibited from intentionally acquiring an asset from a related party of the fund.

The exception, business real property, must be acquired for market value but there are Stamp duty exemptions in some States liked Section 62A of the NSW Stamp Duties act. Business real property is an interest in real property where the property is used wholly and exclusively in one or more businesses. It does not have to be in your own business but it can be and this is why the strategy has been so popular with business people.

The borrowing structure

This diagram shows a typical limited recourse borrowing structure:

Funding Options

There are two main funding options available:

1) Related party lending: There is no restriction on you, your family, a related trust, or similar entity lending the money to the SMSF. The benefits of this are that you can avoid costly bank legal adviser fees and other incidental costs of borrowing from a bank. You must follow the suggested ‘Safe Harbour Provisions’ outlined in ATO guidance on related party SMSF loans (LRBAs) . You cannot put in place a loan that is worse in commercial terms for the SMSF.

In any self -funding scenario you have to expect greater scrutiny by the auditor and regulators so as to avoid any compliance issues, SMSF members choosing self-funding should ensure their loan to the fund is properly documented and meets the requirements of the SIS Act. For example, the trustee of the SMSF must ensure that all investments are conducted on an arm’s length basis. This means that a proper lease agreement must be in place, repayments must be scheduled and met and as mentioned above the terms of the loan cannot disadvantage the SMSF in comparison to what’s available in the market.

2) Third party lending: Nearly all the major banks, and some specialised non-bank lenders, have developed SMSF loan packages specifically tailored to meet the requirements of the Act. I really do recommend that you seek advice from a broker who has experience in this area as the terms and conditions offered by the various lenders differ dramatically as some deal with them through their residential lending division and others through their commercial divisions.

The bottom line: Placing real estate assets into your self-managed superannuation fund can be both straightforward and financially sensible, but there are certain rules you need to follow carefully, In the next instalment of our SMSF session we will guide you through the steps involved in the process from start to finish. Please seek independent professional advice to ensure that any proposed strategy complies with the law, because there are severe penalties that can apply if the trustee gets it wrong.

NEXT STEP : THE PROCESS OF BUYING PROPERTY IN AN SMSF (all states are slightly different but follow these steps to ensure you don’t fall foul of the rules)

As always please contact me if you want to look at your own options. You can make an appointment by clicking here. We have offices in Castle Hill and Windsor but can meet clients anywhere in Sydney or via Teams or Zoom or FaceTime .

Liam Shorte B.Bus FSSA™ AFP

Financial Planner & Fellow SMSF Specialist Advisor™

Tel: 02 98993693, Mobile: 0413 936 299

PO Box 6002, Norwest NSW 2153

40/8 Victoria Ave Castle Hill NSW 2154

Corporate Authorised Representative of Viridian Advisory Pty Ltd ABN 34 605 438 042, AFSL 476223

This information has been prepared without taking account of your objectives, financial situation or needs. Because of this you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation and needs. This website provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such.