OK, yet again we have only a short time left to the end of the 2024 financial year to get our SMSF in order and ensure we are making the most of the strategies available to us. Here is a checklist of the most important issues that you should address with your advisers before the year-end.

It’s been another busy year and I have not had as much time to put this together so if you find an error or have a strategy to add then please let me know. Links were working at the time of writing.

Warning before we begin,

Before we start, just a warning as in the rush to take advantage of new strategies you may have forgotten about how good you have it already Be careful not to allow your accountant, administrator or financial planner to reset any pension that has been grandfathered under the pension deeming rules that came in on Jan 1st 2015 without getting advice on the current and possible future consequences resulting in the pension being subject to current deeming rates if you lose the grandfathering. Point them to this document

- It’s all about timing

If you are making a contribution, the funds must hit the super fund’s bank account by the close of business on 30 June. Some clearing houses hold on to money for up to 14 days before presenting them to the super fund. Some Retail and Industry funds are asking for funds at least 7 days before the end of the financial year!

In addition, pension payments must leave the account by the close of business unless paid by cheque in which case the cheques must be presented within a few days of the EOFY. There must have been sufficient funds in the bank account to support the payment of the cheques on 30 June but a cheque should only be your very last-minute option! You can also ask your adviser or administrator about a Promissory Note if time is against you but funds are ready.

So, for SMSFs get your payments in the fund by Monday 24th June or earlier to be sure (yes I’m Irish) as the 30th is a Sunday this year. This is even more important if using a clearing house for contributions.

- Review your Concessional Contributions (CC) options and new rules

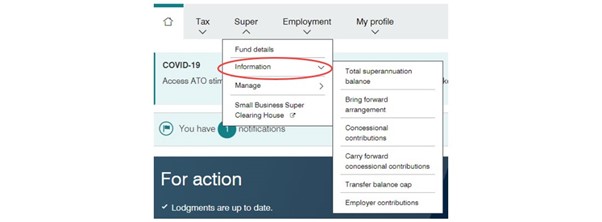

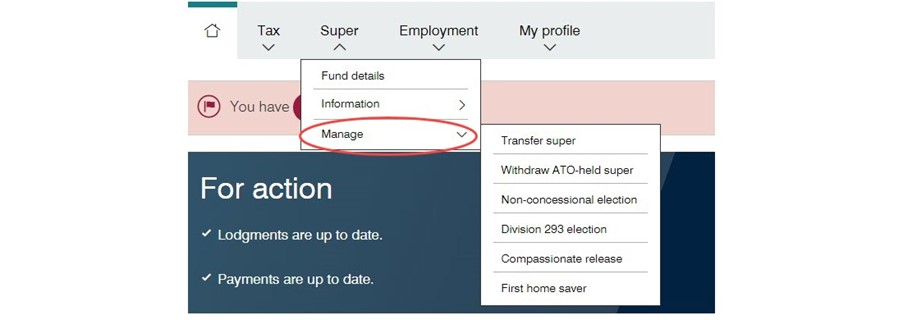

The government changed the contribution rules from 1 July 2020 to extend the ability to make contributions from age 65 up to age 67. Read more here. Maximise contributions up to CC cap of $27,500 but do not exceed your limit unless you have Unused Carried Forward Concessional limits and Total Super Balance under $500K as of last 01 July 2022. Guidance on how to check your Unused Carried Forward Concessional limits via MyGov records available here

Some of the sting has been taken out of excess contributions tax but you really don’t need the additional paperwork to sort out the problem. Check employer contributions on normal pay and bonuses, salary sacrifice and premiums for insurance in super as they may all be included in the limit.

- Consider using the ‘Unused Carry Forward Concessional Contribution” limits

Broadly, the carry forward rule allows individuals to make additional CC in a financial year by utilising unused CC cap amounts from up to five previous financial years. Eligibility requires a total superannuation balance just before the start of that financial year of less than $500,000 (across all your super accounts).

This measure applies from 2018-19 so effectively, this means an individual can make up to $132,500 of CCs in a single financial year by utilising unapplied unused CC caps since 1 July 2018. Guidance on how to check your Unused Carried Forward Concessional limits via MyGov records available here

This is the last year to use the 2018/19 unused Carried Forward Concessional Caps as they fall outside the 5 year rolling period from 30 June 2024.

Beware that once your Income including Salary, Investment income, Employer SGC, Personal Concessional Contributions goes over $250,000 you will be subject to Div 293 Tax

From 1 July 2024 the Concessional Cap rises to $30,000 per year. Super Guarnatee also rises to 11.5%. Re-evaluate your contribution plans for 2024-25

- Review plans for Non-Concessional Contributions (NCC) options

From 1 July 2022 the NCC contribution rules changed and currently the age limit of 75 (28 days after the end of the month your turn 75) applies to NCCs (that is, from after-tax money) without meeting the work test. Check out ATO superannuation contribution guidance.

NCCs are an opportunity to move investments into super and out of a personal, company or trust names.

Even-up spouse balances and maximise super in pension phase up to age 75. For couples where one spouse has exhausted their transfer balance cap and has excess amounts in accumulation are able to withdraw from the higher balance and recontribute to the other spouse who has transfer balance cap space available to commence a retirement phase income stream. This can increase the tax efficiency of the couple’s retirement assets as more of their savings are in the tax-free pension phase environment.

Make your tax components more tax free by using recontribution strategies. SMSF members can cash out their existing super and re-contribute (subject to their contribution caps) them back in to the fund to help reduce tax payable from any super death benefits left to non-tax dependants. From 1 July 2022 you can do this until they turn age 75 (contribution to be made with 28 days after the end of the month you turn 75).

From 1 July 2024 the Non-Concessional Cap rises to $120,000 per year or $360,000 under the 3 Year Bring Forward Rule. Re-evaluate your contribution plans for 2024-25

RECONTRIBUTION STRATEGIES

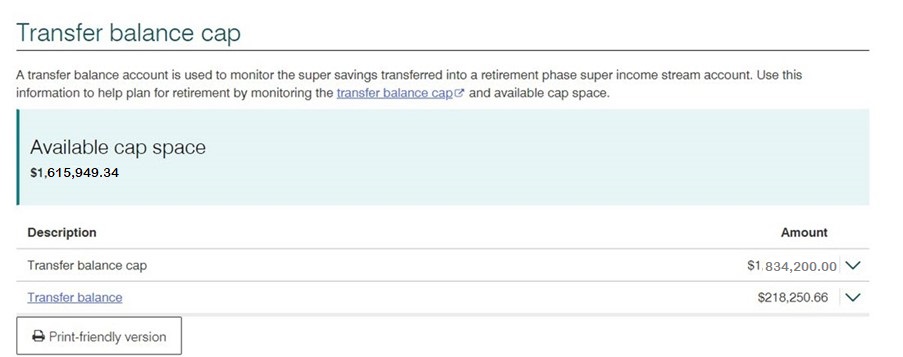

Consider doing the drawdown before 30 June 2023 so that your Transfer Balance Cap and Total Super Balance on 1 July 2024 gets some additional space with the rise in the TBAR and TSB full limits to $1.9m. Note that if you had and existing pension(s) at 30 June 2023 your current limit will be anywhere between $1.6m and $1.9M (Frustrating for Advisers!)

If you have additional funds to add to the withdrawal then maybe take up to $330,000 before June 30 and then you may be able to contribute up to $360,000 using the new Non-Concessional Cap.

- Downsizer contributions

If you have sold your home in the last year and you are over 55, consider eligibility for downsizer contributions of up to $300,000 for each member.

From 1 jan 2023, the eligibility age to make downsizer contributions into superannuation was reduced from 60 to 65 years of age. All other eligibility criteria remain unchanged, allowing individuals to make a one-off, post-tax contribution to their superannuation of up to $300,000 per person from the proceeds of selling their home. These contributions will continue not to count towards non-concessional contribution caps.

The $300,000 downsizer limit (or $600,000 for a couple) and the $330,000 bring forward NCC cap allow up to $630,000 in one year contributions for a single person and $1,260,000 for a couple subject to their contributions caps. That rises on 1 July 2024 to $660,000 for a single person and $1,320,000 for a couple subject to their contributions caps

PLEASE BE CAREFUL AS THIS IS A ONCE ONLY STRATEGY AND IF YOU WOULD BENEFIT MORE IN OLDER YEARS USING THE STRATEGT THE MAXIMISE NCCs FIRST.

- Calculate co-contributions

Check your eligibility for the co-contribution, it’s a good way to boost your super. The amounts differ based on your income and personal super contributions, so use the super co-contribution calculator.

- Examine spouse contributions

If your spouse has assessable income plus reportable fringe benefits totalling less than $37,000 for the full $540 tax offset or up to $40,000 for a partial offset, then consider making a spouse contribution. Check out the ATO guidance here.

You can implement this strategy up to age 75 as a Spouse Contribution is treated as a NCC in their account (and therefore counted towards your spouse’s NCC cap).

- Give notice of intent to claim a deduction for contributions

If you are planning to claim a tax deduction for personal concessional contributions, you must have a valid ‘notice of intent to claim or vary a deduction’ (NAT 71121).

A notice must be made before you commence the pension. Many people like to start pension in June and avoid having to take a minimum pension in that financial year but make sure you have claimed your tax deduction first. The same notice requirement applies if you plan to take a lump sum withdrawal from your fund.

- Consider contributions splitting to your spouse

Consider splitting contributions with your spouse, especially if:

- your family has one main income earner with a substantially higher balance or

- if there is an age difference where you can get funds into pension phase earlier or

- if you can improve your eligibility for concession cards or age pension by retaining funds in superannuation in the younger spouse’s name.

This is a simple no-cost strategy I recommend for everyone here. Remember, any spouse contribution is counted towards your spouse’s NCC cap.

- Act early on off-market share transfers

If you want to move any personal shareholdings into super (as a contribution) you should act early. The contract is only valid once the broker receives a fully-valid transfer form so timing in June is critical. There are likely to be brokerage costs involved.

- Review options on pension payments

The government has not extended the Temporary Reduction in Minimum Pensions as part of the COVID-19 response. Ensure you take the standard minimum pension at your age-based rate. If a pension member has already taken pension payments of equal to or greater than the the minimum amount, they are not required to take any further pension payments before 30 June 2024. For transition to retirement pensions, ensure you have not taken more than 10% of your opening account balance this financial year.

Minimum annual payments for pensions for 2023/24 financial year onwards.

OK we are back to normal rates from 01/07/2023, no more COVID reductions.

| Age at 1 July | 2023-24 Back to Standard Minimum % withdrawal |

| Under 65 | 4% |

| 65–74 | 5% |

| 75–79 | 6% |

| 80–84 | 7% |

| 85–89 | 9% |

| 90–94 | 11% |

| 95 or older | 14% |

If a pension member has already taken a minimum pension for the year, they cannot change the payment but they can get organised for 2024/-25. So, no you can’t sneak a payment back into the SMSF bank account!

If you need more than the minimum pension payments for living expenses then it may be a good strategy for amounts above the minimum to be treated as either:

- a partial lump commutation sum rather than as a pension payment. This would create a debit against the pension member’s Transfer Balance Account (TBA). Please discuss this with your accountant and adviser first as all funds now have to report this quarterly to the ATO.

- for those with both pension and accumulation accounts, take the excess as a lump sum from the accumulation account to preserve as much in tax-exempt pension phase as possible.

- Check your documents on reversionary pensions

A reversionary pension to your spouse will provide them with up to 12 months to get their financial affairs organised before making a final decision on how to manage your death benefit. In NSW this may avoid issues with Binding Death Nominations and the Notional Estate (see Benz v Armstrong; Benz v Armstrong; Benz v Armstrong – 2022 NSWSC)

You should review your pension documentation and check if you have nominated a reversionary pension in the context of your family situation. This is especially important with blended families and children from previous marriages that may contest your current spouse’s rights to your assets. Also consider reversionary pensions for dependent disabled children.

The reversionary pension has become more important with the application of the $1.6-$1.9 million Transfer Balance Cap (TBC) limit to pension phase from 01/07/2023.

Tip: If you have opted for a nomination instead then check the existing Binding Death Benefit Nominations (many expire after 3 years) and look to upgrade to a Non-Lapsing Binding Death Benefit Nomination. Check your Deed allows for this first.

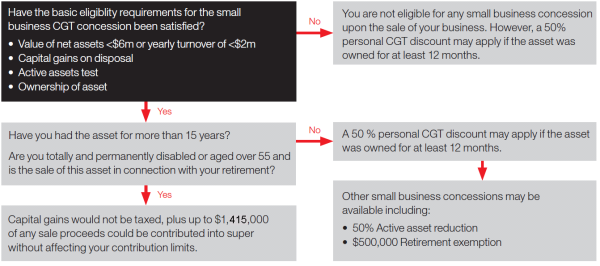

- Review Capital Gains Tax on each investment

Review any capital gains made during the year and over the term you have held the asset and consider disposing of investments with unrealised losses to offset the gains made. If in pension phase, then consider triggering some capital gains regularly to avoid building up an unrealised gain that may be at risk to legislation changes.

- Collate records of all asset movements and decisions

Ensure all the fund’s activities have been appropriately documented with minutes, and that all copies of all statements, valuations and schedules are on file for your accountant, administrator and auditor.

The ATO has now beefed up its requirements for what needs to be detailed in the SMSF Investment Strategy so review your investment strategy and ensure all investments have been made in accordance with it and the SMSF Trust Deed, including insurances for members. See my article on this subject here.

- Arrange market valuations

Regulations now require assets to be valued at market value each year, including property and collectibles. For more information refer to ATO’s publication Valuation guidelines for SMSFs.

On collectibles, play by the new rules that came into place on 1 July 2016 or remove collectibles from your SMSF.

Tip: The ATO is targeting audit compliance this year on Property Valuations in SMSFs as we approach the implementation of the Division 293 Tax from 1 July 2025.

- Check the ownership of all investments.

Make sure the assets of the fund are held in the name of the trustees (including a corporate trustee) on behalf of the fund. Carefully check any online accounts and ensure all SMSF assets are separate from your other assets.

We recommend a corporate trustee to all clients. This might be a good time to change, as explained in this article on Why SMSFs should have a corporate trustee.

- Review Estate Planning and loss of mental capacity strategies

Review any Binding Death Benefit Nominations (BDBN) to ensure they are valid, and check the wording matches that required by the Trust Deed. Ensure it still accords with your wishes.

Also ensure you have appropriate Enduring Powers of Attorney (EPOA) in place to allow someone to step into your place as trustee in the event of illness, mental incapacity or death.

Check your Trust Deed and the details of the rules. For example, did you know you cannot leave money to stepchildren via a BDBN if their birth-parent has pre-deceased you?

- Review any SMSF loan arrangements

Have you provided special terms (low or no interest rates, capitalisation of interest etc) on a related party loan? Review your loan agreement and see if you need to amend your loan.

Have you made all the payments on your internal or third-party loans, have you looked at options on prepaying interest or fixing the rates while low?

Have you made sure all payments in regards to Limited Recourse Borrowing Arrangements (LRBA) for the year were made through the SMSF trustee? If you bought a property using borrowing, has the Holding Trust been stamped by your state’s Office of State Revenue? For Related Party LRBA’s the Variable interest rate is currently 8.85%

- Ensure SuperStream obligations are met

For super funds that receive employer contributions, the ATO is gradually introducing SuperStream, a system whereby super contributions data is made electronically.

All funds should be able to receive contributions electronically and you should obtain an Electronic Service Address (ESA) to receive contribution information.

All funds should be able to receive contributions electronically and you should obtain an Electronic Service Address (ESA) to receive contribution information.

If you change jobs your new employers may ask SMSF members for their ESA, ABN and bank account details.

- Ensure you are meeting your Quarterly TBAR Reporting deadlines

From 1 July 2023 you need tio be checking in with your accountant/administrator Quarterly

All SMSFs are required to report quarterly, even if the members total super balance is less than $1 million. This means you must report the event that affects the members transfer balance within 28 days after the end of the quarter in which the event occurs.

Example: All unreported events that occurred between 1 April and 30 June 2024 must be reported by 28 October 2023. This means you cannot report at the same time as your SMSF annual return (SAR) for the 2023-24 income year. More info here

- ASIC fee increased from 1 July 2023

ASIC is increasing fees by $4 for the annual review of a special purpose SMSF trustee company $59 to $63. The Government is moving gradually to a “user pays” model so expect increases to accelerate in future years. Before 30 June, for $407 you can pre-pay the company fees for 10 years and lock in current prices with a decent discount. There is a remittance form linked here.

- HAS NOT PASSED: Relaxing residency requirements for SMSFs– Labor Government has failed to move on this issue.

SMSFs and small APRA funds still do not have relaxed residency requirements through the extension of the central management and control test safe harbour from two to five years as the LNP government failed to pass it before the last election and Labor have put it on the backburner. The active member test was also to be removed, allowing members who are temporarily absent to continue to contribute to their SMSF.

- HAS NOT PASSED: Legacy retirement product conversions (Under Review STILL by Government)

Individuals were to be able to exit a specified range of legacy retirement products, together with any associated reserves over a two-year period but the legislation was not passed and is now to be reviewed by the new Government. The specified range of legacy retirement products includes market-linked, life expectancy and lifetime products, but not flexi-pension products or a lifetime product in a large APRA-regulated or public sector defined benefit scheme.

Currently, these products can only be converted into another like product and limits apply to the allocation of any associated reserves without counting towards an individual’s contribution cap.

There is considerable additional detail in this feature so consult an adviser if you are affected, especially to ensure you do not lose other entitlements such as the age pension.

- Improving the Home Equity Access Scheme – Social security benefits for you or your mum and/or dad

The Home Equity Access Scheme formerly called The Pension Loan Scheme is now up and running. The Government introduced a No Negative Equity Guarantee for HEAS loans and allow people access to a capped advance lump sum payment.

- No negative equity guarantee – Borrowers under the HEAS, or their estate, will not owe more than the market value of their property, in the rare circumstances where their accrued HEAS debt exceeds their property value. This brings the HEAS in line with private sector reverse mortgages.

- Immediate access to lump sums under the HEAS – Eligible people will be able to access up to two lump sum advances in any 12-month period, up to a total value of 50% of the maximum annual rate of Age Pension (currently $14,511.90 for singles and $21,876.40 for couples).

- Careful if replacing Income Protection or TPD Insurance (Total Permanent Disability)

Have you reviewed your insurances inside and outside of super? Don’t forget to check your current TPD policies owned by the fund with an own occupation definition as the rules changed a few years ago so be careful about replacing an existing policy as you may not be able to obtain this same cover inside super again.

There were major changes to Income Protection insurance in 2021 so be very careful about switching insurer unless costs have blown out as new cover is often vastly inferior to current covers. Read more here before switching cover.

- Large one-off Personal income or gain – Bring forward Concessional Contributions

For those who may have a large taxable income this year (large bonus or property sale) and are expecting a lower taxable next year you should consider a contribution allocation strategy to maximise deductions for the current financial year. This strategy is also known as a “Contributions Reserving” strategy but the ATO are not fans of Reserves so best to avoid that wording! Just call is an Allocated Contributions Holding Account. See my article on this strategy here.

- Providing Proof of Crypto Currency Holdings as of 30 June.

You should be using an exchange that is set up for SMSF accounts. They should provide a Tax Summary but it may cost extra. Independent Reserve provides one audited by KPMG for $50. COINSPOT also offer tax reports that meet Australian Audit requirements.

The auditor will also want to verify holdings by checking:

- An exchange account is set up in the name of the fund

- Wallet purchased using funds from the SMSFs cash account

Cold Wallet Audit management extra step: For annual audit purposes, take a screenshot of the assets held in your Ledger wallet (e.g. via the Ledger ‘Live’ App or similar) on 30 June 2023 and also on the day you submit your paperwork and email this to the tax agent at tax time.

Don’t leave it until after 30 June, review your Self Managed Super Fund now and seek advice if in doubt about any matter.

One for I July 2024 Check your Salary Sacrifice or Concessional Contributions as SG rises to 11.5%

So busy, I forgot the superannuation guarantee (SG) rate will increase from 11% to 11.5% on 1 July 2024. You’ll need to use the new rate to calculate how much of your new indexed limit of $30,000 concessional cap will be available to salary sacrifice or make personal deductible contributions.

Warning before you jump into implementation of any strategy without checking your personal circumstances.

Are you looking for an advisor that will keep you up to date and provide guidance and tips like in this blog? then why now contact me at our Castle Hill or Windsor office in Northwest Sydney to arrange a one-on-one consultation, just click the Schedule Now button up on the left to find the appointment options.

Please consider passing on this article to family or friends. Pay it forward!

Liam Shorte B.Bus FSSA™ AFP

Financial Planner & Fellow SMSF Specialist Advisor™

Tel: 02 9899 3693, Mobile: 0413 936 299

- PO Box 6002 NORWEST NSW 2153

- Suite 40, 8 Victoria Ave, Castle Hill NSW 2154

- Suite 4, 1 Dight St., Windsor NSW 2756

Corporate Authorised Representative of Viridian Advisory Pty Ltd ABN 34 605 438 042, AFSL 476223

This information has been prepared without taking into account your objectives, financial situation, or needs. Because of this, you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation, and needs. This website provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such.