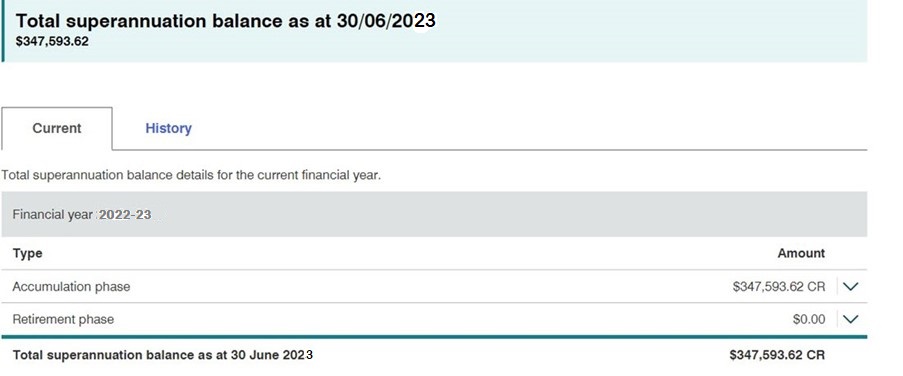

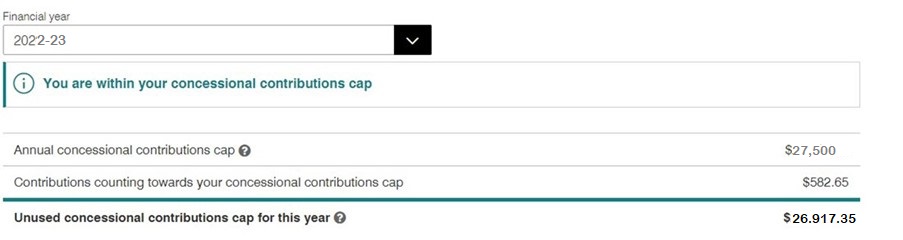

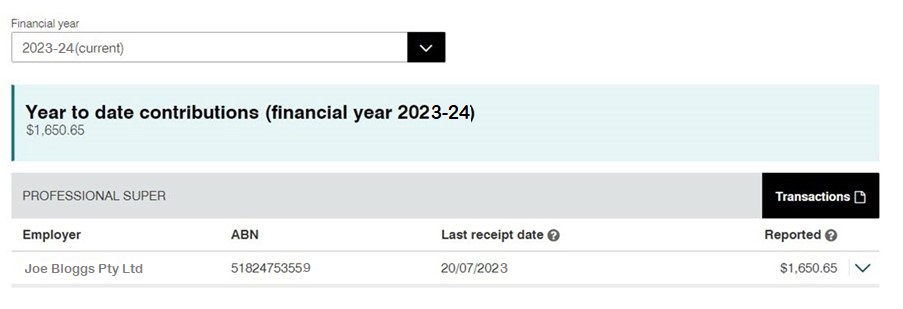

Before ever making Non-Concessional Contributions to your Superannuation of engaging in a re-contribution strategy you always need to check your personal Total Super Balance Cap.

The December 2024 Consumer Price Index (CPI) data has confirmed that the superannuation general transfer balance cap will rise by $100,000, to $2.0 million for the 2025–2026 income year. For SMSFs please remember that each member has their own Transfer Balance Cap (TBC). This increase marks the latest adjustment to the cap, which was first introduced in 2017. The transfer balance cap is a lifetime limit on the amount of superannuation that can be transferred into one or more retirement phase income streams (pension accounts) within your SMSF and/or across industry and retail funds, where earnings on superannuation are currently tax-free. Additionally, income or withdrawals after the age of 60 are generally tax-free. The cap was introduced to promote fairness in the distribution of superannuation tax concessions and to ensure the long-term sustainability of the superannuation system. While there are some flaws, it has been accepted as a fair system.

Unlike other superannuation caps, such as contribution caps, the general transfer balance cap and total super balance caps are adjusted annually based on the CPI, in $100,000 increments, rather than being indexed to Average Weekly Ordinary Time Earnings (AWOTE). The cap has increased progressively: from $1.6 million from 2017 to 2021, to $1.7 million from 2021 to 2023, to $1.9 million from 2023 to 2024, and will rise to $2.0 million for the 2025–2026 year. Please note the Concessional Contribution cap ($30K) and Non-Concessional Contribution Cap ($120K) are not increasing.

Personal Transfer Balance Cap (the thorn in the side if advisers!)

The personal transfer balance cap is specific to each individual when they first start a retirement phase income stream. Your personal cap will match the general transfer balance cap at the time. Therefore, if you start your retirement phase income stream on or after 1 July 2025, your personal transfer balance cap will be set at $2.0 million.

If you began your income stream before 1 July 2025, your personal transfer balance cap would range anywhere from $1.6 million to $1.9 million, depending on the specific year you started your first pension. If you didn’t use the full amount of your personal transfer balance cap at the time, a proportional increase may apply to your personal transfer balance cap on 1 July 2025. So don’t be surprised to be told you have a TBC if $1,713,325 as it can get that very personalised!

What if I contribute too much?

If you exceed your personal transfer balance cap, you must remove the excess from your income stream and either take it in cash or transfer it back into your superannuation account. An excess transfer balance tax would then be payable. The ATO will notify you if you’ve exceeded your cap.

Other Changes Related to Indexation

The indexation of the transfer balance cap will have a flow-on effect on other superannuation measures linked to this cap, including the total superannuation balance test. Starting from 1 July 2025, the total superannuation balance test will increase to $2 million. This balance determines eligibility for making after-tax non-concessional contributions and using the bring-forward rule.

If your total superannuation balance is below $2 million as of 30 June 2025, you’ll be able to make non-concessional contributions starting 1 July 2025, as long as you are under age 75. Additionally, the bring-forward rule will apply against the higher cap.

For those under 75 at 1 July 2025, and if you haven’t triggered the bring-forward rule in the previous financial years, you may contribute up to $360,000. Where an individual’s balance is close to $2 million, they can only make a contribution or use the bring forward to take their balance to $2 million but not beyond.

| TSB on 30 June of prior financial year | Contribution and bring-forward available |

| Less than $1.76m | 3 years ($360,000) |

| $1.76m to < $1.88m | 2 years ($240,000) |

| $1.88m to < $12m | 1 year ($120,000, no bring-forward available) |

| $2m and above | Nil |

Changes to Government Co-Contribution and Spouse Contributions Tax Offset

Eligibility for a government co-contribution and entitlement to the spouse contributions tax offset will also be affected by the total superannuation balance test, which will be $2 million from 1 July 2025.

Opportunity

The increase in the superannuation general transfer balance cap (TBC) to $2.0 million for the 2025–2026 income year presents significant opportunities for individuals and SMSF Trustees looking to maximize their retirement savings. As the transfer balance cap (TBC) affects various aspects of superannuation, such as total superannuation balance (TSB) tests and eligibility for non-concessional contributions, it is essential to review your superannuation strategy in light of these changes. Working with an SMSF Specialist Advisor can help you optimize your superannuation contributions to your SMSF, plan for retirement, and ensure that you stay compliant with the latest regulations.

Warning before you jump into implementation of any strategy without checking your personal circumstances and the specifics of the property you are considering.

Are you looking for an advisor that will keep you up to date and provide guidance and tips like in this blog? Then, why not contact me at our Castle Hill or Windsor office in Northwest Sydney to arrange a one-on-one consultation (after 1 July 2025 due to our waiting list). Just click the Schedule Now button up on the left to find the appointment options.

Please consider passing on this article to family or friends. Pay it forward!

Liam Shorte B.Bus FSSA™ AFP

Financial Planner & Fellow SMSF Specialist Advisor™

Tel: 02 9899 3693, Mobile: 0413 936 299

- PO Box 6002 NORWEST NSW 2153

- Suite 40, 8 Victoria Ave, Castle Hill NSW 2154

- Suite 4, 1 Dight St., Windsor NSW 2756

Corporate Authorised Representative of Viridian Advisory Pty Ltd ABN 34 605 438 042, AFSL 476223

This information has been prepared without taking into account your objectives, financial situation, or needs. Because of this, you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation, and needs. This website provides an overview or summary only and it should not be considered a comprehensive statement on any matter or relied upon as such.